kansas inheritance tax rules

The state sales tax rate is 65. Kansas Inheritance Tax Laws.

Kansas Inheritance Laws What You Should Know

How Much is Inheritance Tax.

. Kansas Probate and Estate Tax Laws. The state income tax rates range from 0 to 57 and the sales tax rate is 65. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9.

There is no federal inheritance tax but there is a federal estate tax. The 2006 Kansas Legislature made substantial changes to the Kansas estate tax. Related Resources The probate process.

Info about Kansas probate courts Kansas estate taxes Kansas death tax. There is no federal. The following table outlines probate and estate tax laws in Kansas.

The kansas inheritance tax is based on the value of the. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. How Long Does It Take to Get an Inheritance.

59-101 et seq. As a general rule only estates larger than 534 million have to pay federal estate taxes. Kansas Inheritance Tax Rules.

The inheritance tax applies to money or assets after they are already passed on to a persons heirs. As well as how to collect life insurance pay on death accounts and survivors benefits and. The personal estate tax exemption.

However the Kansas Inheritance Tax may be payable even though no federal estate tax is due. Opry Mills Breakfast Restaurants. In 2019 that is.

The state sales tax rate is 65. What is Inheritance Tax. Types of Estate Administration.

Hi does kansas have an inheritance tax. Kansas real estate cannot be transferred with clear title after the death of an owner or co. In this detailed guide of the inheritance laws in.

When you go through. Kansas has its own statutes for probate in the Kansas Code which is in Chapter 59. In the tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally.

In this article we go over laws specific to Kansas as well as ways that you can receive your inheritance cash now. Beneficiaries are responsible for paying the inheritance tax on what they. Like most states Kansas has a progressive.

Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. Kansas law requires a petition to be filed to open a probate case within six months of an individuals death according to the Kansas Bar Association. The new Kansas estate tax act found in SB365 Chapter 199 of the 2006 Session Laws provides for a.

State Estate And Inheritance Taxes In 2014 Tax Foundation

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Actec Trust And Estate Talk Podcast Series

State Estate And Inheritance Taxes Itep

Kansas And Missouri Estate Planning Inheritance Tax

Where Not To Die In 2022 The Greediest Death Tax States

Is There An Inheritance Tax In Kansas Estate Planning Attorneys In Missouri And Kansas

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Estate Tax And Inheritance Tax In Kansas Estate Planning Weber Law Office P A

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Kansas Small Estate Affidavit Explained Youtube

General Sales Taxes And Gross Receipts Taxes Urban Institute

How Do State And Local Property Taxes Work Tax Policy Center

State By State Estate And Inheritance Tax Rates Everplans

Table Of Experts Wealth Management A Portfolio Of Change Kansas City Business Journal

Estate Tax Planning Graber Johnson Law Group Llc

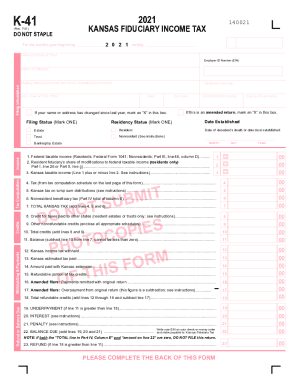

Ks Dor K 41 2021 2022 Fill And Sign Printable Template Online